Does child support have tax implications? In particular, do child support payments received add to taxable income?

The answer is no. Child support does not count as taxable income. Furthermore, how much child support you receive appears to have no significant tax consequences in Australia.

Child support payments received can reduce Family Tax Benefit Part A. That’s perhaps the main financial disadvantage from receiving child support.

Let’s explore further why child support is not taxable income. I’ll also explain why, in some cases, payers may be advantaged by declaring child support paid.

Child Support is Just a Cash Transfer Between Parents

The way to think about about child support payments is that they’re simply cash transfers between parents.

Cash is essentially money after tax. In whatever way the funds were obtained, all deductions have already been claimed and any associated tax has been paid. The money is there, ready to be spent on things like rent, food and clothing.

It just so happens that, under a child support agreement or obligation, one parent gives the money to the other parent to do the spending.

Why You Might Think Child Support is Taxable Income

You might think child support is taxable income because payments such as JobSeeker, Parenting Payment and Austudy are taxable; they count as income. A full list of taxable Centrelink payments is shown here. Child support is different from these taxable government payments since the money comes from another person.

But child support payments can affect FTB Part A

Beyond a certain threshold, receiving child support does reduce the amount of Family Tax Benefit (FTB) Part A you receive however. This is effectively a penalty against the parents and children of separated families.

We reduce your FTB by 50 cents for every dollar of child support you receive over the threshold. We call this threshold the Maintenance Income Free Area. We apply these automatically.

Services Australia

Services Australia provides an example where Sally is assessed to receive $5,000 in child support this financial year. Based on her income and other factors, Sally would also be entitled to receive $4,423.80 in FTB Part A. But the Government takes half of every dollar of child support above a threshold of $1,686.30. This reduces the amount of family tax benefit Sally receives by $1,656.85, from $4,423.80 down to $2,766.95.

If Australia had a system of deductions and liabilities for child support

If a different system were in place, child support payments received would count as income. You could have a system where (a) the payer claims payments as a deduction against their income and (b) the recipient has to declare child support as income.

This hypothetical arrangement would work out because the payer’s tax deduction cancels out the recipient’s higher reported income. The amount of tax collected by the Australian Taxation Office (ATO) would be about the same, around zero, unless the payer were in a higher tax bracket.

But we don’t have such a system in place, perhaps because it would (a) advantage payers to be able to deduct child support from their gross income (b) disadvantage receivers to have to declare more of their income and (c) reduce tax collection by the Australian Government since payers have higher incomes on average.

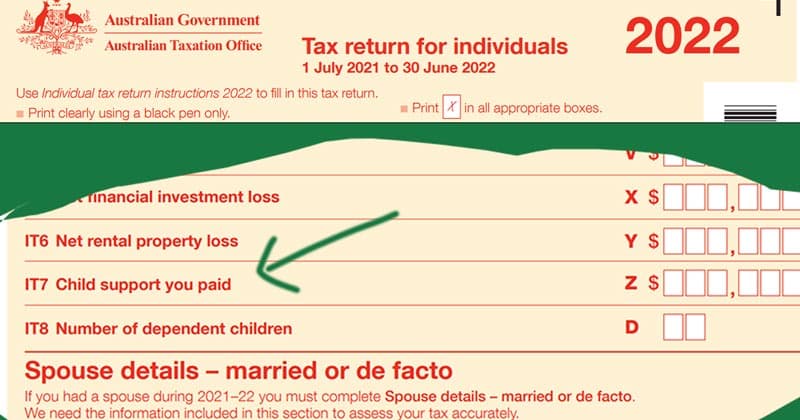

What About the Income Tax Return Form?

You may have noticed when you do your annual tax return in Australia that you’re asked to report Child support you paid. The ATO also required you to declare Child support your spouse paid in another question.

While child support received is not taxable income, could there be some deduction available for child support paid? If you’re a payer, could you claim a deduction?

The only information I can see about this relates to a few government welfare programs where you’re allowed to deduct child support payments from adjusted taxable income. How much child support you pay can affect family assistance payments, low income supplements and the Carer Allowance (Source: Services Australia).

It’s important to note that adjusted taxable income is very different from taxable income. The adjustments can be program specific and include all sorts of things that may not normally be considered in tax calculations.

Taxable Income Affects Child Support, Not the Reverse

The relationship between taxable income and child support can be explained fairly simply. The higher your taxable income, the less child support you receive or the more you pay. The starting point for Services Australia calculating child support is the taxable (or gross) income of each parent.

Taxable income strongly affects child support in fact. With 50/50 parenting, for example, you can have large child support payments if one parent earns significantly more than the other.

Services Australia also have an adjusted income concept, where they fiddle around with the basic income measure. They deduct a self-support amount for all parents. Services Australia also adds in things like reportable superannuation contributions, preventing parents from switching employment compensation to non-taxable forms.

While income affects child support, the reverse doesn’t really apply. How much you receive or pay in child support doesn’t impact on your reportable income. The ATO treats child support payments as if the parents were still together and sharing their after-tax income for the benefit of the kid(s).

The bottom line is that you can relax about child support payments when it comes to doing your annual tax return. Child support received is not included in taxable income. Payments made are also not part of the income tax calculation, although they may affect your eligibility for certain welfare programs or the amounts you receive from them.

Taylor cole

if you pay 20k a year child support and the year after do your tax return, does it affect your income for child support? because I’ve noticed the How much child support did you pay question on the tax return and wondering what there saying to stich me up this time? probably just to see how much my ex gets tax free, it’s crazy the amount I pay for one child is more than centrelink give a.grown adult on jobseeker thats with rent assistance too, she has my other boy whose 21 and working herself and her new bloke all.sharing bills and food, and I pay 1800 for my lad a month, and centerlink gives a single mother an extra 400ish a month for the child, I can’t see how centrelink can say that’s what it costs to look after a child for a month but child support say my boy is worth 1800 a month? I wouldn’t know where that cash goes either it’s absolutely no accountability 2 branches of government that work hand in hand witheach other what a joke, then they say everyone in society are equal, you clowns are creating division from early on in a child’s life, the adds are on TV now that your relying on charities to pick up the slack,

Andrew Lancaster (admin)

For better or worse (mostly worse), the child support scheme has been designed to try to re-create the financial circumstances of an intact family. That means trying to elevate the overall living standards of the parent who dominates care and/or has little income.

Sam

I have the children (2) 51% of time. She didn’t work from our 1st child’s birth. She left me (no abuse) 3 days after we came back to Australia (we were living in Europe, she is Australian). She has not work full time since (my children heard her say that she has to be careful of the number of hours she works or she will lose welfare benefits and child support). There is absolutely no incentive for her to work (Centrelink was on my back from the start). She has a new partner they build a house together with swimming pool. Her mother live with them (she participates in mortgage and all). While I’m struggling to pay rent. Overall the children have a better material situation and better holiday with her (trip , beach house…), and she has more time to do her things.

On the other hand I had to stay in Australia to be with my children. I lost my family, my friends, my job, my career and my country. I have been struggling for 10 years to rebuild my life. I have now a new career. I could live correctly (meaning able to pay the necessity without stress) but because I have to pay child support (which is really financing her lifestyle not the children) I am struggling to make ends meet. The best holidays, I can offer are short camping trip.

My mother died (in France) last year which incurred a number of expenses. I had to choose between paying my rent or paying child support. I chose my rent. I explained my situation to Child support. They don’t care, I have to pay, period. So I am now in a dire situation which has and will have negative impact on the children’s material life with me. Obviously it is not the children welfare that is at the centre. This system is not looking after the children and is not fair. They input income and Care % in an equation, they don’t care about the reality for the children and the parent’s particulars. It is an incentive for some parents to work as little as possible, to give up altogether fighting for their kids (I’ve seen fathers giving up, too scared to spend a fortune in lawyer and lose and pay a fortune in child support). In the justice system it would be like if we replaced Judges by computer to input the offence and it will output the sanction via a table without looking at the particulars. An absolute disgrace.

Fed Up

So mg ex makes over 100k. I have the children 50%. I have to pay for everything additional on top (all their clothes, haircuts etc) and pay her 1250 a fortnight. which she gets tax free.

it’s a horseshit system. she was also the abusive one. I left as I’d had enough.

Jhil

It is useful to know the in and out regarding the child support mandate

Lee

I can’t agree more with the above. I have 60% care and am expected to pay child support to the kids dad who refuses to work. so not only do I have majority care and thus more expenses, but i pay for all medical expenses and schooling, but I have to pay HIM because he won’t work and i work full time? seams fair…

There needs to be a major overhaul, I believe if it’s 50/50 it should be on each parent to earn income to support. if you have more care, you should have to pay a cent. it’s absolutely encouraging people to not work!

Dave

Why would my ex want to work? We have 50/50 custody, and between her Centrelink payments and what I give her, she takes home about $1600 per fortnight. That’s better than what some people with jobs earn. Plus, I pay for everything for my two kids. At 50% custody, we arguably incur the same costs. So why the hell should I pay more on top of all the stuff I buy for them anyway?

There’s absolutely no incentive for the bludgers.

Shane Nicholls

The way this is calculated is unfair for the payer. My ex-partner has all the opportunities to work yet chooses not to, because the less income she has, the more I have to pay. When I try to improve my financial situation to benefit my child’s inheritance, I get slammed with a higher rate of child support. I am totally entitled to be on a disability pension and not work at all. Additionally, I believe that because she left a non-abusive relationship, she should not be entitled to any higher rate other than a capped value. I am more than happy to contribute to my son’s experiences and welfare, but I believe the calculations need to be changed. Moreover, I have him every Tuesday night from 4 till 7 for dinner, and the same every second Thursday. However, because it’s not an overnight stay, it doesn’t count. So, should I be requesting her to supply his nappies and food for those hours I have him?