How Child Support is Calculated

Watch and comment in YouTube

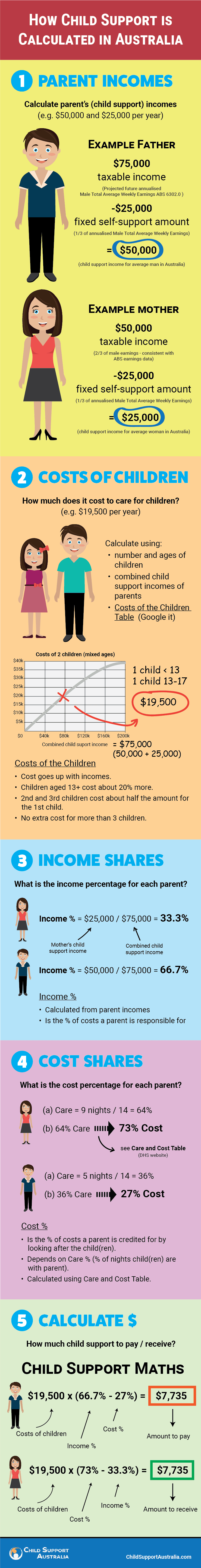

To learn how child support is calculated in Australia (how it works), check out the infographic and discussion below.

To estimate your child support payments, use the calculator / estimator (it's cleaner than the government version).

Concept and method: how it works

Child support payments are calculated using a complex formula (though it's called the "basic formula"). While the calculations are complex, the principles are understandable.

- Each parent is responsible for meeting the costs of children.

- Costs depend on the number and ages of children.

- Higher income parents are required to contribute more.

- A parent gets credit for covering expenses while caring for the child(ren).

- You pay support when your Income % > your Cost %.

In the final calculation, child support is calculated as the Costs of the Children multiplied by the difference between your Income % (share of combined income) and your Cost % (credit for time with the child(ren)).

You pay child support if the result is positive and receive support if it is negative. However, you never have to pay if you have at least 65% care.

Information used to calculate support

Child support is normally worked out using just this information:

- taxable incomes of parents

- percentage of nights each parent has the child(ren)

- number of children aged < 13 and number aged 13-17

- info on any other dependents.

1. Parent Incomes

The incomes of parents are an essential part of calculating child support in Australia.

Taxable income

The formula uses taxable income, which is the income you report to the ATO when you submit your tax return. It is your gross, before-tax income rather than net income. You'll have a smaller amount of income left to spend after paying income and other taxes.

Typically, the formula uses the taxable income reported in your most recent tax return.

Self-support amount

The formula assumes each parent needs a certain amount of income just to maintain themselves. This is calculated as one-third of annualised Male Total Average Weekly Earnings (MTAWE). The 2017 Self-Support Amount was $24,154.

Child support income

For the purposes of calculating child support, each parent has a Child Support Income. It is your taxable income minus the Self-Support Amount minus the costs of any dependents. Child Support Income quantifies your capacity to maintain children financially. As detailed below:

- the Parents' Combined Child Support Income is used to calculate Costs of the Children (or, for dependents, just one parent's income)

- the Income % for a parent determines the share of costs he or she must meet (via payments or care).

2. Costs of the Children

The financial costs of raising children are captured by the Costs of the Children measure. To calculate it, you need to use the Australian Government's Costs of the Children Table.

Number of children

The formula allows for the extra cost of more children. In approximate terms, a 2nd child adds 50% to costs compared to a single child. A 3rd child adds the same amount again (so 3 children cost twice as much as 1). Any more children make no difference.

Ages of children

In working out child support payments, there's a small allowance for a child's age. Children aged 13+ cost about 20% more in the Costs of the Children table compared to children aged 12 and under.

Child support normally stops when a child reaches 18, though continuation rules exist for children still in secondary education.

Income

The Costs of the Children measure increases with the incomes of the parents.

- If both parents have a taxable income below the Self-Support Amount, the Costs of the Children measure is nil.

- A cap on the Costs of the Children applies when the Parents' Combined Child Support Income reaches 2.5 times MTAWE. The cap normally corresponds with a combined taxable income of 3.167 times MTAWE (or $230k using the 2017 MTAWE).

- The highest Costs of the Children possible in 2017 was $51,448 – for high-income parents with 3 or more children aged 13+.

The treatment of income in calculating the Costs of the Children is controversial. Cost inflation is excessive at medium to high income levels (see examples).

3. Income Shares

The calculation of income shares is an important calculation step. For each parent, an Income % is calculated as his or her Child Support Income divided by the Parents' Combined Child Support Income.

The Income % is interpreted under the formula as the % of the Costs of the Children which must be covered by the parent. You can meet costs either by providing care for the children or by paying child support.

- For example, if you make 60% of the combined income amount – your Income % is 60% – you must meet 60% of the Costs of the Children.

- If, based on how many nights you have the child(ren), your Cost % is greater than this, you have excess cost credits and will receive child support.

- If, on the other hand, your Cost % is < 60%, your required financial contribution exceeds care costs and you must pay child support.

4. Cost Shares

When a parent has care of the child(ren), he or she gets credit meeting for child-rearing expenses. The % of the Costs of the Children for which you are credited is your Cost %.

Your Cost % is determined from your Care % using the Care and Cost Table (here).

- The Care % is the proportion of nights in a year for which you have custody of the child(ren).

- Typically, it is calculated by dividing the number of nights you have the child(ren) each fortnight by 14.

The Care and Cost Table produces differences between the Cost % and the Care %. The purpose of these distortions is unclear but, for many parents, the Cost % is roughly the Care %.

- While the Cost % usually approximates the Care %, it can be higher or lower due to a number of bends in the cost function.

- See the Division of Care section for more details.

5. Calculation of Child Support

To calculate child support, the final step is to multiply the Costs of the Children value by the difference between your Cost % and Income %.

- You receive child support if your Care % is > 35% and your Cost % > your Income %.

- You pay child support when your Care % < 65% and your Income % > your Cost %.

The Department of Human Services (DHS) is responsible for determining child support and notifying parties of how exactly much they must pay or are entitled to receive.

An assessment contains an annual figure, an amount which must be paid each month, and the current balance. Assessments can be altered to account for special circumstances through a Change of Assessment review.