About the Assessment Calculator

The child support calculator estimates how much you may need to pay or receive as a separated parent in Australia. It uses the formula defined in the Child Support (Assessment) Act – see How It Works.

The calculator is not suitable for complex cases, such as those involving multiple child support arrangements.

Having additional dependents in your household can improve your assessment by reducing your liability or increasing your entitlement.

Low-Income Payers

Low-income payers pay relatively small amounts of child support. For those with less than shared care (fewer than 5 overnights per fortnight), a fixed rate applies. This is set to $1,720 per child per year (2024 rate), capped at three children.

However, if you recently received income support, a $519 minimum annual rate applies. If you also have at least regular care (at least 2 nights per fortnight), you can apply to have the payment reduced or waived.

Care Percentage Calculator

Use our care percentage calculator to get a detailed estimate of child support. The calculations are generally consistent whether you use care percentage or nights per fortnight. However, especially with shared custody, holidays or schedule changes can affect the final payment. You need the care percentage to account for holidays and other disruptions.

How much child support will I pay if I make $100k?

If you make $100k per year in Australia, child support payments generally fall between $11.6k and $22.6k annually. This assumes no visitation. The exact amount depends on the number of children, their ages, and how much time they spend with you. Fewer children and more time with them lead to lower payments.

New Facebook Group!

We're now offering an easier way to ask questions and share experiences. Go to and like the Child Support Australia FB page for updates.

What's Wrong with Our System?

Watch and comment in YouTube

Income sharing and hybrid models

Alternative assessments are provided using income sharing and hybrid models. These models correct for conceptual and mathematical flaws in Australia's child support scheme. For further detail, see A Fairer System.

Purpose of child support

The Child Support Scheme was designed to ensure that both parents contribute to the cost of their children, according to their capacity. There are approximately 1.3 million parents and 1.1 million children involved in the Scheme, and more than 40 per cent of Australian families who receive Family Tax Benefit include a child support parent.

The Child Support Program was introduced in Australia in 1988 to strike a fairer balance between public and private forms of support for children [and] to alleviate the poverty of sole parent families. The Program has undergone a range of changes since its original introduction in the late 1980s, including the substantial changes on 1 July 2008 to the child support formula and the introduction of the Costs of the Children Table.

Maximum income in calculations

The maximum child support payable is also known as the “cap”. The maximum child support is applied to the combined income of both parents up to 2.5 times the annual equivalent of all Male Total Average Weekly Earnings (MTAWE) and calculated using the Costs of Children Table.

CSA vs private collect

Separated parents will be registered with the CSA if either parent makes an application to the CSA for a child support assessment. Parents can choose whether to have child support paid via private arrangement between parents ("private collect agreement"), or have it collected from the non-resident parent by the CSA and paid to the resident parent ("CSA collect agreement"). According to the CSA's administrative data, [47%] of child support cases registered with the CSA were CSA collect cases; the remaining [53%] were private collect.

Fair or unfair assessment?

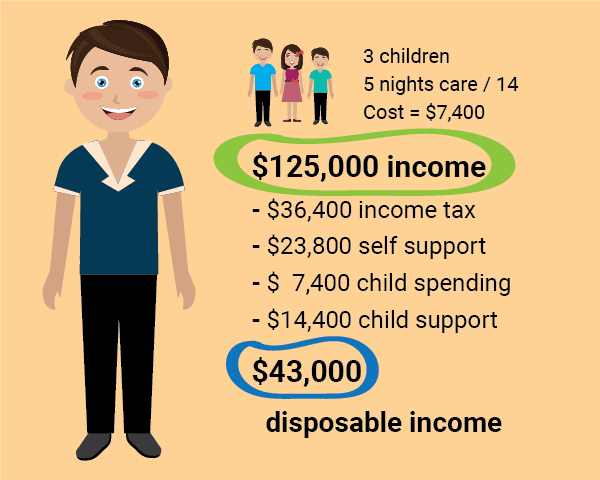

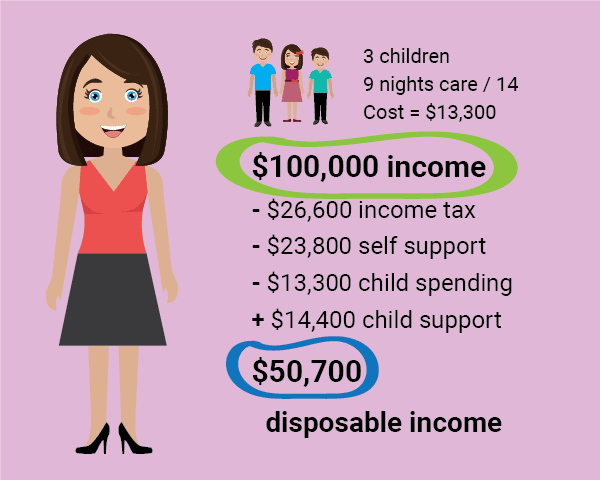

Here is an income and care scenario which highlights issues with the child support formula. For more examples, see the examples page.

- The parents have shared care of 3 children, who spend 9 nights out of 14 with their mother.

- Basic child-raising costs were estimated based on formula costs for parents on average incomes.

- Both parents are on good incomes, with the father earning $25,000 more.

- Child support payments leave the mother in a significantly stronger financial position.

Child support was estimated using the calculator on this page (older version). The calculator was also used to estimate child-raising costs - as the Costs of the Children for parents with a combined taxable income of 5/3 x annualised MTAWE (and cost % = care %). Taxes were estimated using personal income tax tables and the Medicare Levy.