Guide to the amounts paid or received by Australian parents.

Child support in Australia varies widely. Most annual assessments fall somewhere between $2,000 and $20,000, although payments can be much lower or much higher in specific situations. The amount is driven by income, care levels, and how the formula treats your family structure.

I’m Dr Andrew Lancaster, an economist who has helped parents understand the child support system since 2017. This article explains the main drivers of assessments using real examples taken from typical Australian cases. The aim is to give you clarity about how the formula works and why results can differ so much between families.

How Child Support Is Calculated

Australia uses the income-shares model under the Child Support (Assessment) Act. Both parents’ child support incomes are combined to estimate the total cost of raising the child or children. Each parent is responsible for a share of that cost based on capacity to pay and adjusted for care levels.

Two points often surprise parents.

- First, child support is not based on the actual cost of living. There is no fixed allowance linked to food, clothing, or rent. The assessment comes from income percentages, not budgets.

- Second, child support behaves much like an income tax system. A higher-earning parent pays a larger share even if day-to-day costs do not change.

Because of this, assessments can feel high or low depending on parental earnings rather than family expenses.

Video: How Much Is Child Support in Australia?

The video on this page walks through real child support examples using the official Australian formula. It shows how payments change as income, care levels, the number of children and their ages change, so you can see why assessments can vary from under $2,000 to well over $20,000 a year.

If you prefer to watch rather than read, start with the video to get an overall feel for how the system works. Then use the article and the Child Support Calculator on this site to plug in your own figures and see what the formula does in your situation.

Minimum and Maximum Payments

A low-income parent with fewer than five nights of care per fortnight pays the Minimum Annual Rate, which is currently $1,768 per year. This ensures a basic level of contribution.

At the upper end, the formula has an income cap. Payments do not keep increasing beyond that point. The highest practical amount for one young child is $26,044 per year. Most families fall well between these two ends.

How Income Changes Child Support

Income is the strongest driver of child support. As income rises, the assessed amount rises quickly. This example uses one child under 13, the other parent on zero income, and the payer having no care.

Payer income:

$0 → $1,768

$50,000 → $3,661

$100,000 → $11,584

$150,000 → $18,000

$200,000 → $23,108

$250,000 → $26,044

This shows how steeply assessments rise with income. Small increases in income can produce large jumps, especially between $80,000 and the upper threshold.

Does the Primary Carer’s Income Matter?

When one parent provides all or almost all of the care, the primary carer’s income changes the assessment only slightly. This happens because the system gives the primary carer full credit for the spending already done in their household. Much of their assessed contribution loops straight back to them.

Example with the payer earning $100,000 and having no care:

Primary carer income:

$0 → $11,584

$50,000 → $11,230

$100,000 → $10,143

$150,000 → $9,108

$200,000 → $7,553

$250,000 → $6,251

These differences are modest. The payer’s income remains the dominant factor. The primary carer can work more without losing much support, or stay at home without dramatically changing the assessment.

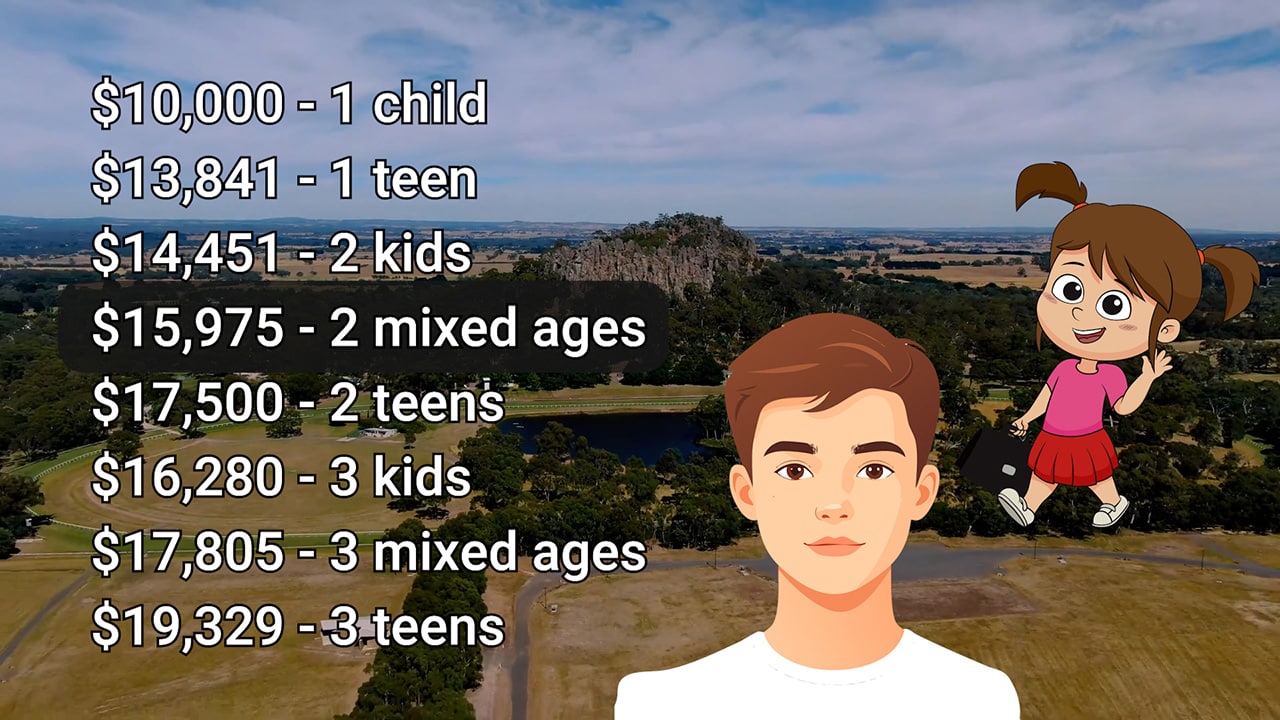

Age and Number of Children

The formula splits children into two groups: under 13, and 13 to 17. Teenagers count more heavily.

Using $10,000 as the baseline for one young child:

1 young child → $10,000

1 teen → $13,841

2 young children → $14,451

1 young + 1 teen → $15,975

2 teens → $17,500

3 young children → $16,280

3 mixed ages → $17,805

3 teens → $19,329

- A teenager can increase the cost by up to 40 percent.

- Two young children cost only a little more than one teenager.

- Three teenagers create the highest assessment.

The formula stops adding cost after three children. A fourth child usually makes no difference. In some cases, adding a young child to a group of teenagers can reduce the assessment because the family changes from “all teens” to “mixed ages”.

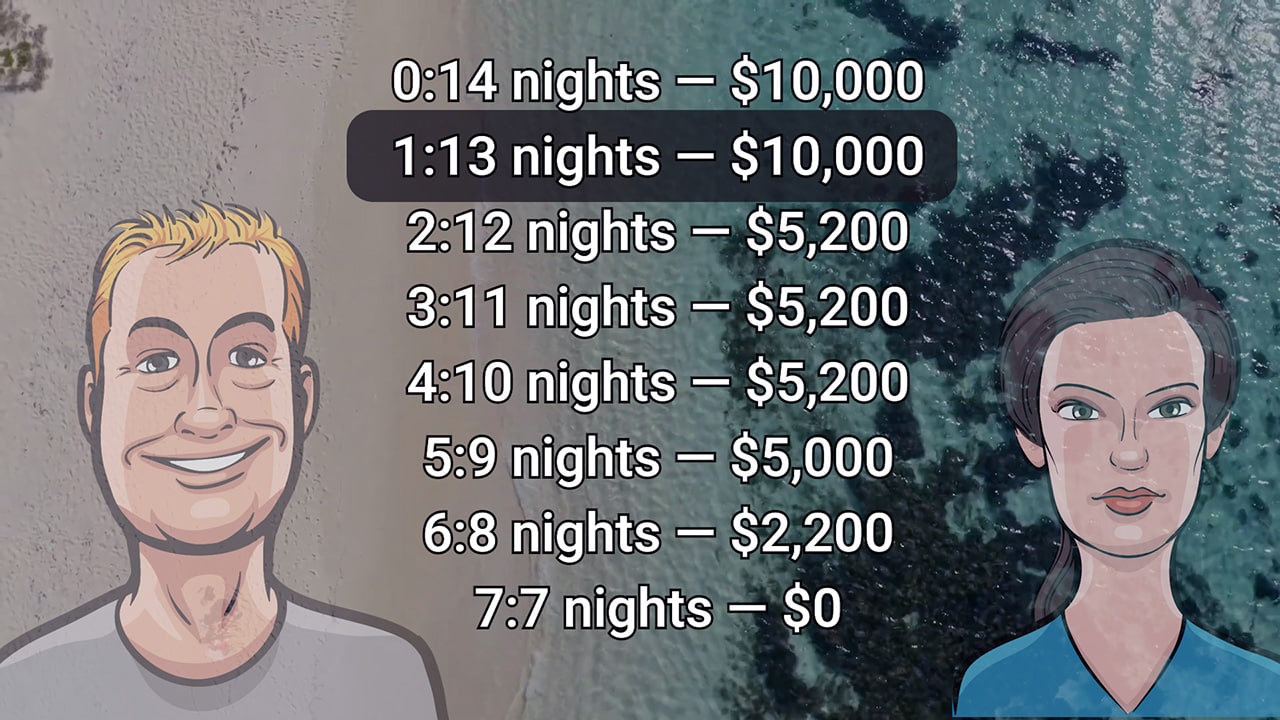

How Care Nights Change the Assessment

Care is measured by nights per fortnight. The more care a parent provides, the more credit they receive.

With one young child and equal incomes of about $98,570 each:

0 nights → $10,000

1 night → $10,000

2 nights → $5,200

3 nights → $5,200

4 nights → $5,200

5 nights → $5,000

6 nights → $2,200

7 nights → $0

There is no reduction at one night. A major drop appears at two nights. Three and four nights produce no further change. Another drop appears at six nights. At seven nights, support reaches zero because care is shared and the incomes are the same.

How Sensitive Payments Are to Payer Income

Child support reacts sharply to changes in the payer’s income. This example uses two children, one young and one teen, with the primary carer earning $50,000 and the payer having five nights of care.

Payer income:

$150,000 → $20,794

$100,000 → $12,444

$50,000 → $2,853

These movements are much larger than the tax savings from the same income drop. The system responds directly to changes in capacity to pay.

Indexation and Annual Adjustments

Child support uses national wage levels (MTAWE) to update threshold amounts each year. When wages rise, the self-support amount rises too. This means child support does not always increase from one year to the next. It may fall slightly even when income stays the same.

Calculate Your Child Support

You can calculate your child support using the Child Support Calculator on this site. It applies the official formula and updates automatically each year. Enter incomes, care levels, and the number of children to see your current assessment and how it changes under different scenarios.

Leave a Reply