To learn how child support is calculated in Australia (how it works), check out the infographic and discussion below.

To estimate your child support payments, use the calculator / estimator, which implements the same formula, tables, and steps described on this page.

Concept and method: how it works

Child support payments are calculated using a complex statutory formula (commonly referred to as the “basic formula”). While the calculations involve multiple tables and thresholds, the underlying structure is coherent and can be explained directly.

The outline below follows the order in which the formula is applied in administrative assessments, rather than offering a high-level summary.

- Each parent is responsible for meeting the costs of children.

- Costs depend on the number and ages of children.

- Higher income parents are required to contribute more.

- A parent gets credit for covering expenses while caring for the child(ren).

- You pay support when your Income % > your Cost %.

In the final calculation, child support is calculated as the Costs of the Children multiplied by the difference between your Income % (share of combined income) and your Cost % (credit for time with the child(ren)).

You pay child support if the result is positive and receive support if it is negative. However, you never have to pay if you have at least 65% care.

Author’s note on method: This explanation is written by an economist who has worked through the child support formula, tables, and thresholds line by line, and who has applied them across hundreds of real assessments. The focus here is not legal interpretation or advocacy, but a faithful explanation of how the formula actually operates in practice.

Information used to calculate support

Child support is normally worked out using only the following inputs, all of which feed directly into the statutory formula:

- taxable incomes of parents

- percentage of nights each parent has the child(ren)

- number of children aged < 13 and number aged 13–17

- information on any other dependents

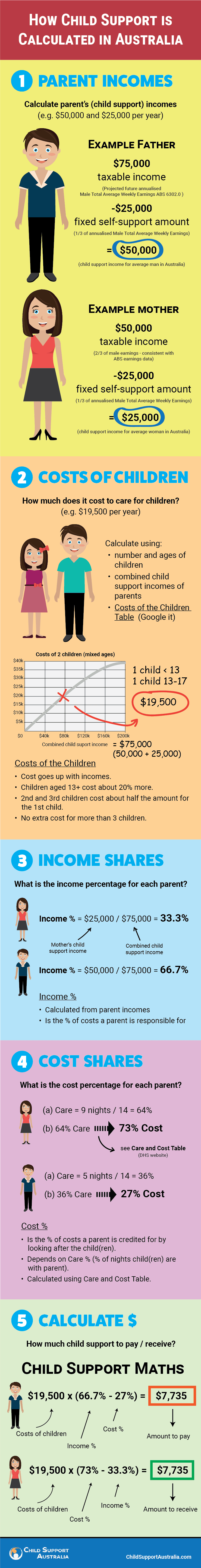

1. Parent Incomes

The incomes of parents are a core input into the formula and determine both the scale of costs applied and how those costs are shared.

Taxable income

The formula uses taxable income, which is the income you report to the ATO when you submit your tax return. It is your gross, before-tax income rather than net income. You'll have a smaller amount of income left to spend after paying income and other taxes.

Typically, the formula uses the taxable income reported in your most recent tax return.

Self-support amount

The formula assumes each parent needs a certain amount of income to support themselves before contributing to child support. This amount is defined in the legislation as one-third of annualised Male Total Average Weekly Earnings (MTAWE) and is indexed over time.

The 2026 Self-Support Amount was $31,046.

Child support income

For the purposes of calculating child support, each parent has a Child Support Income. It is your taxable income minus the Self-Support Amount minus the costs of any dependents. Child Support Income represents the portion of income treated as available for supporting children.

- the Parents' Combined Child Support Income is used to calculate the Costs of the Children (or, for dependents, just one parent's income)

- the Income % for a parent determines the share of costs he or she must meet, either through payments or care

2. Costs of the Children

The financial costs of raising children are captured by the Costs of the Children measure. This is not estimated case by case, but taken directly from the Australian Government’s statutory Costs of the Children Table.

Number of children

The formula allows for the extra cost of additional children. In approximate terms, a second child adds around 50% to costs compared to a single child. A third child adds the same amount again (so three children cost roughly twice as much as one). Any more children make no difference.

Ages of children

In working out child support payments, there is an allowance for a child’s age. Children aged 13 and over attract higher costs in the Costs of the Children table than children aged 12 and under.

Child support normally stops when a child reaches 18, though continuation rules exist for children still in secondary education.

Income

The Costs of the Children measure increases with the incomes of the parents.

- If both parents have a taxable income below the Self-Support Amount, the Costs of the Children measure is nil.

- A cap applies once the Parents' Combined Child Support Income reaches 2.5 times MTAWE. This corresponds to a combined taxable income of 3.167 times MTAWE (or $230k using the 2017 MTAWE).

- The highest Costs of the Children figure in 2017 was $51,448, applying to high-income parents with three or more children aged 13+.

The treatment of income in calculating the Costs of the Children is controversial. Cost inflation becomes pronounced at medium to high income levels (see examples).

3. Income Shares

The calculation of income shares determines how the total costs are apportioned between parents. For each parent, an Income % is calculated as his or her Child Support Income divided by the Parents' Combined Child Support Income.

The Income % represents the share of the Costs of the Children the parent is expected to meet, either through direct care or financial transfer.

- For example, if you earn 60% of the combined income, your Income % is 60% and you are expected to meet 60% of the Costs of the Children.

- If your Cost % (based on care) exceeds this, you receive child support.

- If your Cost % is lower, you must pay child support.

4. Cost Shares

When a parent has care of the child(ren), they receive credit for meeting child-rearing expenses. The percentage of the Costs of the Children credited to you is your Cost %.

Your Cost % is derived from your Care % using the Care and Cost Table (here).

- The Care % is the proportion of nights in a year for which you have the child(ren).

- It is commonly estimated by dividing the number of nights per fortnight by 14.

The Care and Cost Table introduces non-linear steps between Care % and Cost %. For many parents the Cost % roughly approximates the Care %, though it can be higher or lower due to the structure of the table.

5. Calculation of Child Support

To calculate child support, the final step is to multiply the Costs of the Children by the difference between your Income % and your Cost %.

- You receive child support if your Cost % exceeds your Income %.

- You pay child support if your Income % exceeds your Cost %.

Services Australia is responsible for determining child support and notifying parties of how much they must pay or are entitled to receive.

An assessment contains an annual figure, a monthly amount, and a running balance. Assessments can be altered for special circumstances through a Change of Assessment review.

This page explains the operation of the formula itself. Separate administrative mechanisms, such as minimum assessments or Change of Assessment decisions, sit around the formula but do not alter its internal structure.